How Banks Assess Mortgage Serviceability in New Zealand

Nov 21, 2025

Banks test your ability to repay with stress rates and expense checks. Learn how mortgage serviceability works — and use our calculator to test your borrowing power.

If you’ve ever wondered why one bank says “yes” to a mortgage and another says “no,” the answer usually comes down to one thing: serviceability. In New Zealand, banks don’t lend based on how much you think you can afford — they lend based on how your financial profile performs against their internal serviceability models, stress-testing rates, and debt-to-income limits.

Understanding how this works gives you a massive advantage, especially in 2025 where lending rules are tight, incomes are scrutinised, and buyers are hitting servicing ceilings more often. This guide breaks down how serviceability is calculated, why stress-testing exists, common reasons borrowers fail, and the practical steps you can take to improve your borrowing power — before you apply.

Disclaimer: This article provides general information only. It does not constitute personalised financial advice or a lending decision. Always consult with a licensed mortgage adviser before applying.

What Is Mortgage Serviceability?

Serviceability is the bank’s assessment of your ability to repay a mortgage — not just today, but under tougher financial conditions. They look at:

How much you earn

How much you spend

How much debt you already carry

What interest rate you could withstand if the market moves against you

Even if you feel financially comfortable, the bank’s view may be different because they apply strict formulas, buffers, and regulatory rules. Serviceability is about proving repayment strength under pressure, not under perfect circumstances.

What Stress-Testing Means

Banks don’t test your mortgage at current interest rates. Even if today’s fixed rates sit around 6.5%, banks will model your loan at a stress-test rate of roughly 8.0–8.5%. This protects borrowers if rates rise, and it satisfies responsible lending obligations under CCCFA.

Working Example

You apply to borrow $600,000 over 30 years.

Repayments at 5.5%: about $3,400/month

Repayments at 8.00% stress rate: about $4,400/month

The bank assesses you on the $4,400, not the $3,400 — and if your income can’t support it (after expenses), your application fails serviceability even though real repayments today are lower.

What Banks Look At in a Serviceability Assessment

Serviceability assessment frameworks vary slightly between lenders, but the core components are consistent:

Income

PAYE salary and wages (usually counted at 100%)

Self-employed income (typically averaged over 2 years, sometimes scaled down)

Rental income (discounted: often 65–80% counted)

Bonuses, commission, overtime (assessed conservatively)

Expenses

Banks use either:

Your actual spending (from bank statements), or

Benchmark minimums based on household size and dependants

Whichever is higher is used.

Existing Debts

Credit cards (the limit, not the balance, is counted)

Personal loans

Car finance

Buy-now-pay-later accounts

Even a single unused credit card with a $10k limit can reduce your borrowing power by $30k–$60k.

Debt-to-Income Ratio (DTI)

Many NZ banks use DTIs when assessing serviceability.

A typical rule:

Most borrowers: DTI cap around 6–7x income

If your proposed loan exceeds this multiplier, your application may be declined regardless of income or deposit.

Why Some People Fail Serviceability

A surprising number of strong earners fail servicing — usually because of factors they didn’t realise mattered.

Common causes:

High DTI ratio (common for buyers in Auckland or Wellington)

Large credit card limits (even unused)

BNPL accounts on statements (Afterpay, Zip, etc.)

Irregular or variable income

High living expenses during the 90-day bank-statement review

Overestimating how banks treat rental income or bonuses

The gap between “what you can afford” and “what a bank approves” is often wider than expected — especially in a high-stress test environment.

How to Improve Your Serviceability

Strengthening serviceability before applying can significantly increase loan approval odds.

Practical steps include:

Reduce or cancel unused credit card limits

Clear personal loans or consolidate debts

Minimise BNPL usage (preferably close accounts before applying)

Extend mortgage term to reduce assessed repayments

Improve bank conduct: no overdrafts, no late payments, no gambling

If you're self-employed: prepare clean financials and avoid income volatility

Work with a mortgage adviser who knows which banks are more flexible on DTI, rental income, or variable earnings.

Servicing isn't just about income; it’s about your financial profile on paper. Optimising that profile is often the fastest path to approval.

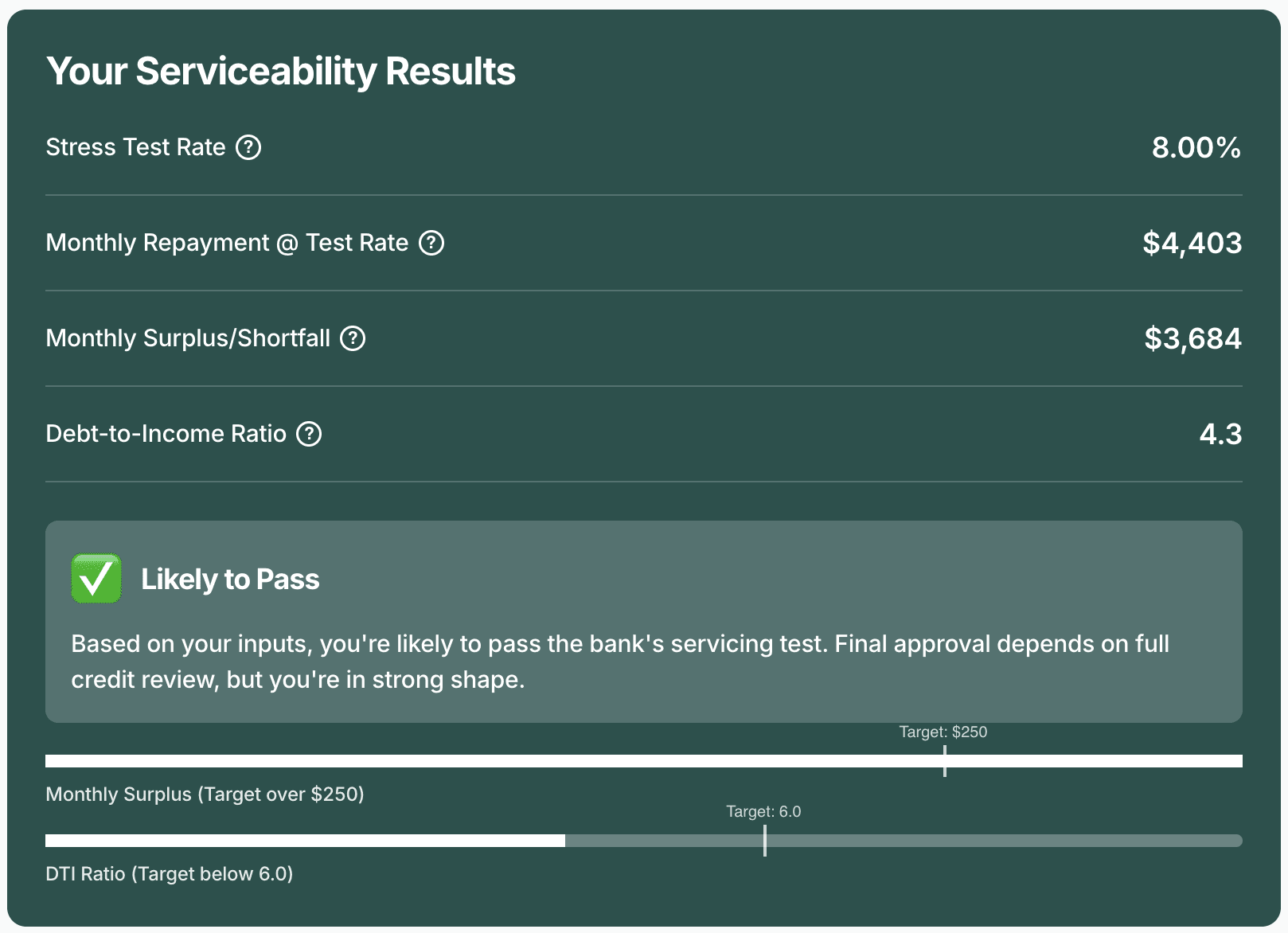

Use Our Calculator to Test Your Borrowing Power

Before applying, test your numbers using our interactive Mortgage Serviceability Calculator. This calculator mimics real NZ bank logic, including:

A calculated stress-test rate mimicking general bank logic

DTI ratio limits

Minimum living expenses based on household size

Scaling for variable income

With it, you can:

Run multiple scenarios

Reduce debt limits and see how much extra borrowing power that unlocks

Print or download a PDF summary to keep or share with an adviser.

If you’re unsure how close you are to approval, this tool gives you clarity instantly.

Our Final Word

If you want to understand exactly how much you can borrow — and how close you are to passing bank servicing rules — start with the calculator, then talk to our mortgage advisers. We’ll break down which banks are most likely to approve your application, what to fix before you apply, and how to structure your loan for long-term success.

Check your borrowing power today — then book a free scenario review so we can map out your next steps.

Disclaimer

This article provides general information only. It does not constitute personalised financial advice or a lending decision. Lending outcomes depend on your financial situation, bank policy, documentation, and credit profile. Always seek personalised advice from a licensed mortgage adviser before applying.

Contact us